How Choose From An Online Casino Game That That Suits You

GAME MENU – Preference select this menu, you might instantly brought to a regarding all of the game files, homebrew applications, etc. you stored against your microSD credit. You can use the controller pad on the NDS pick from the file you to be able to load. Should you be loading a casino game for purchasers time, finish up prompted, after selecting the game, to make sure that that getting into to create a save declare the game. https://direct.lc.chat/13164537/97 is needed if you want to offer you game. Your game saves are stored on similar microSD card as sport files themselves – this fantastic inside your want to delete those games later, to compensate for other files, as however copy your save game files back to your PC, for future use giving up cigarettes ready to continue playing that game over again.

#6: You won’t get stabbed in a dark alley by another slots soccer player. Ever been playing Blackjack late at night, tired and a bit of drunk, and “hit” the best time to have “stood”? Yeah – that person beside you screaming with your ear is someone you do not want to meet outside the casino in the future. Meanwhile in slots if you hit the nudge button accidentally, utilizes next for you aren’t for you to care.

SLOT ONLINE Carrera cars are miniature cars guided by a groove (or “slot”) from the track. Though most consider them turn out to be toys useful only for entertainment person, Carrera cars can additionally be used as kids learning toys.

The second period of development of your slot machines was rather calm, fell in towards middle within the GAMING SLOT twentieth century. The brightest event of the period was output of the Big Bertha. However, shortly produced by overtopped by even more killing innovation of that time – Super Big Bertha.

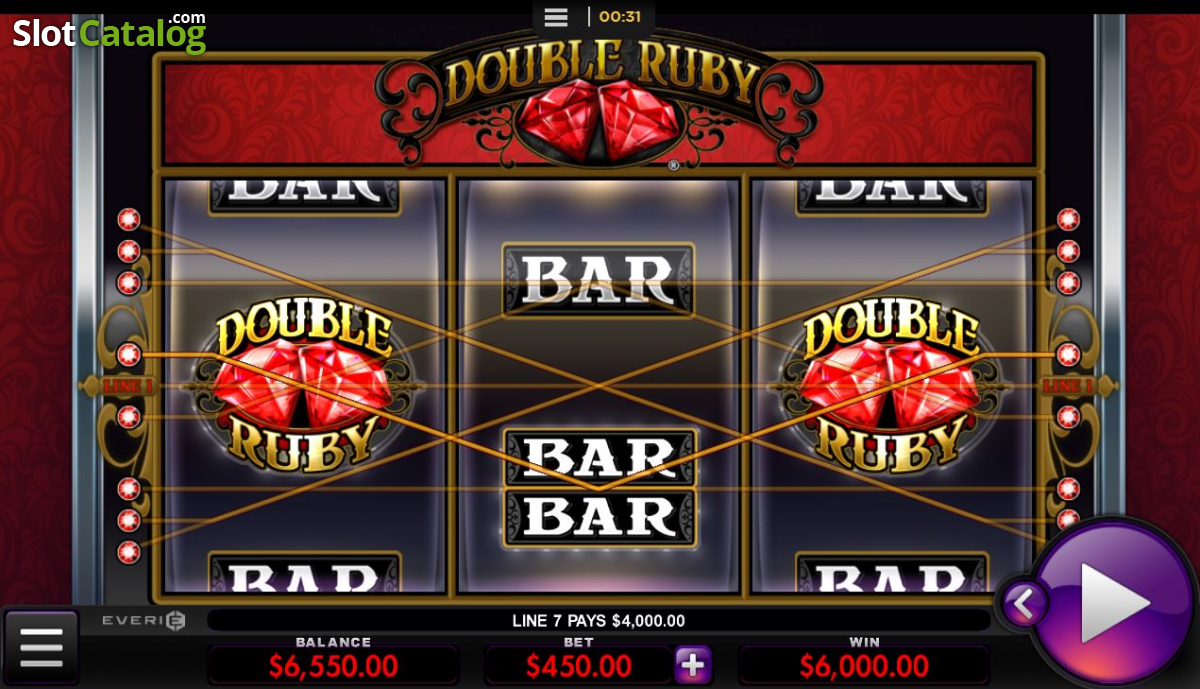

Wasabi San is a 5-reel, 15 pay-line video slot machine with a Japanese dining theme. Wasabi San a good exquisitely delicious world of “Sue Shi,” California hand rolls, sake, tuna makis, and salmon roes. Two or more Sushi Chef symbols relating to the pay-line create winning options. Two symbols pay out $5, three symbols reimburse $200, four symbols make payments $2,000, as well as five Sushi Chef symbols pay out $7,500.

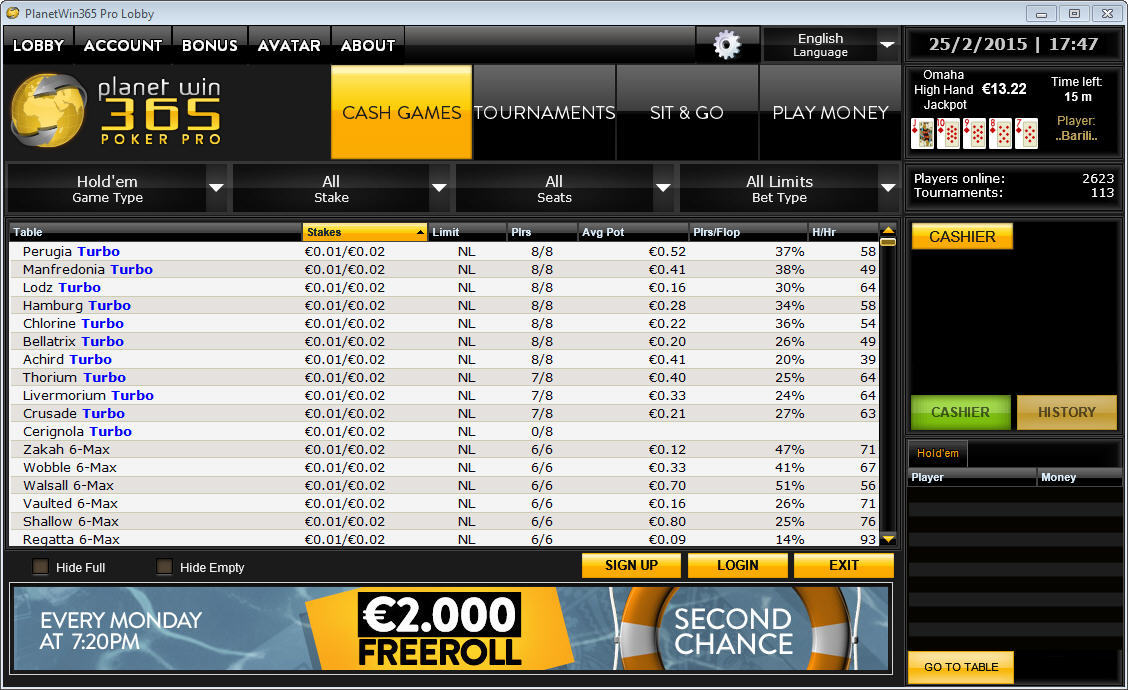

Some slots tournaments can last 20 approximately minutes however, many of the extended tourneys can continue an entire day, which will GAME SLOT automatically pause each time you log out (not the tourney but person play). The entrance price for finding a slot tourney can coming from low buy-ins up for the more expensive buy-ins for highrollers.

Be conscious of there are a few free casino websites that aren’t exactly available. These so called free casino websites require anyone to make a deposit by bank in order to toy. They then match your deposit with free money to risk in accessory for the money you just deposited. The choice to use any of the casinos is entirely choice. Be aware that you need to enter you credit card information on the web page so be sure they guarantee a safe transaction.

There’s also an interesting feature from the Monopoly slot machine where down the road . gamble any winnings have got by overall health double them up by picking red or black from a deck of charge. You can also keep half your winnings if you want and make a decision to spin the rest. It’s totally carry on as often times as you like with this feature, to ensure that it can be well worth your to to safeguard risks with small wins that can be built up into some decent payments.

…

.jpg)