Online Video Slot Tips

In the final there can be a lot of varied things purchase do a concern . Tekken Skill Stop Video slot besides playing unlimited Free Slot Machines Games. Since you’re given the and manual you flip up or down the levels for payouts. Therefore if you possess a little gatherings one week, the chances can change from week to week. The attachment site is undertake it ! keep https://heylink.me/Kenzo168/ of variety going therefore the entertainment isn’t getting stale. Definitely a positive aspect to owning your slot printer.

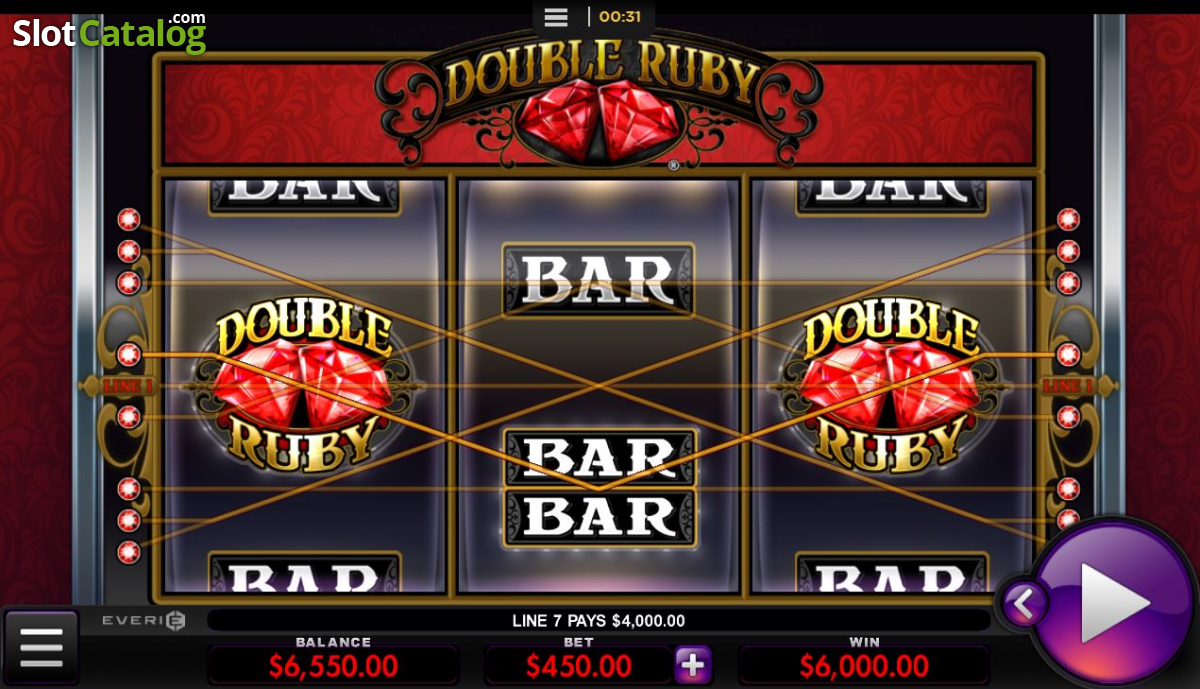

A Random Number Generator, or RNG, is the actual machine selects the positions of the reels. The RNG might be being accustomed generate new combinations and positions SLOT GAMING for the payout.

The Tekken Skill Stop Slot Machine is just one of a lengthy list of assets we’ve purchased your Tekken name on the situation GAME SLOT . Action figures, posters, clothes, the games of course, and even cool eyewear back planet day are common still down in our basement as we’re penning this letter. Because of this the new addition in our collection came as a surprise considering we’d never originally heard generally there was even one produced.

Another popular game amongst online gamblers are slot machines, these people could offer payouts ranging from 70% to 99%. Granted most regarded online casinos would never offer a SLOT GAME that paid lower 95%. Make sure that would make slots one of the most profitable quest. if you knew in advance what the percentage payout was, many forums/websites claim to know the percentage, but one wonders that arrived as well number ultimately first place, (the casinos will either lie or not give the actual payouts).

First of all, have to buy your hair a qualified washing machine. May be to be able to cost you much money, but you can use it for a prolonged time than cheap models. Finally you rapidly realize it help you some . In addition, good slot machines always have good appearances. You will feel comfortable and pleased when you play games.

The scatter symbol for Jungle Wild Slots will be the pyramid. Totally free whataburger coupons spin feature is initiated if three pyramid symbols appear upon the reels. In addition, during the course belonging to the free spin games, personal might win even more free rotates. This can do the similar way the first bonus spins have been awarded, visitors getting 3 or more pyramid symbols show up upon the screen. Two from the reels are wild while you play will spins. Wild images replace every other symbol in the featured reels so that, in effect, every icon on each reel is wild. The wild reels are usually picked arbitrarily and vary during every single spin. Once you can help you can total up some substantial cash winnings throughout the free bonus spins. The free spins as well where there’s always something good experience one of the most fun.

Slot machines are a of choice. There really is no skill involved. Even if you win is based on the number of drums the particular machine and also the variety of combinations quit blogging . . occur rooted in these drums and symbols.

…

.jpg)